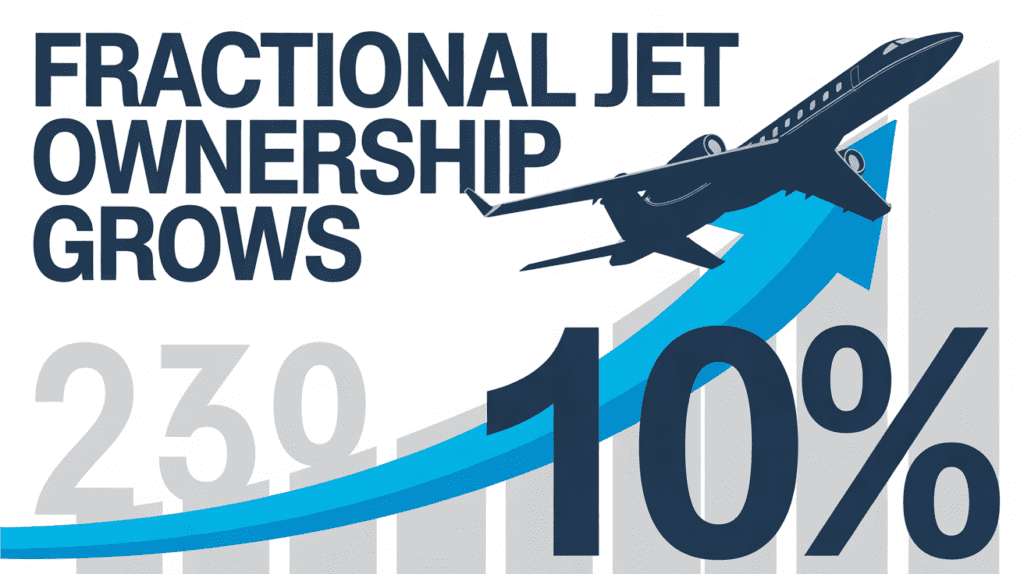

Why fractional ownership is driving the $26.6B private aviation boom. Compare costs, benefits, and find the best way to fly private today. Request a quote!

The global demand for luxury travel is soaring, and recent data shows fractional ownership is a primary catalyst behind the private aviation industry hitting a staggering $26.6 billion valuation. For high-net-worth individuals and corporate decision-makers, the appeal of private flight has shifted from a mere luxury to a critical productivity tool.

However, navigating the complexities of jet ownership, maintenance, and sky-high charter costs can be daunting. Whether you are looking to bypass commercial terminal delays or scale your business operations, understanding the nuances of the modern aviation market is essential. This guide explores how you can leverage the current $26.6 billion industry surge to access premium flight solutions that offer the perfect balance of cost and convenience.

What Is Fractional Ownership in Private Aviation?

Fractional ownership is a legal and financial arrangement where multiple individuals or companies share the costs of purchasing, leasing, and operating a private aircraft. Instead of buying a whole jet—which involves massive capital expenditure and management headaches—you purchase a “share” (typically ranging from 1/16th to 1/2 of the aircraft).

This model is designed for frequent flyers who need the reliability of a private fleet without the full-time responsibilities of maintenance, staffing, and hangarage. It bridges the gap between on-demand jet charters and full aircraft ownership, providing guaranteed access to a tail number with as little as 4–10 hours’ notice.

How Fractional Ownership and Private Jet Access Works

Accessing the world of private aviation has become more streamlined than ever. Here is the step-by-step process of how the modern model operates:

- Needs Assessment: Determine your annual flight hours (typically 50+ hours per year justifies fractional models).

- Share Selection: You purchase a share size based on your expected usage. A 1/16th share usually equates to 50 flight hours per year.

- Capital Contribution: You pay an acquisition fee for your portion of the aircraft.

- Operational Management: A management company (like NetJets or Flexjet) handles the pilots, insurance, and maintenance.

- Booking Your Flight: Simply request your jet via a dedicated concierge or app.

Cost, Pricing, and Value Breakdown

Understanding the financial commitment is vital for any high-intent buyer. While fractional ownership requires an upfront investment, it often provides a better ROI than full ownership for those flying under 200 hours a year.

| Feature | Fractional Ownership | Full Jet Ownership | On-Demand Charter |

| Upfront Cost | $500k – $3M+ | $5M – $65M+ | $0 |

| Monthly Management | $5,000 – $15,000 | $20,000+ | $0 |

| Hourly Rate | Moderate (Fixed) | Low (Direct Operating) | Higher (Market Rate) |

| Maintenance | Handled by Provider | Owner’s Responsibility | N/A |

| Tax Benefits | Potential Depreciation | High Depreciation | Limited |

Benefits of Fractional Ownership Over Alternatives

The $26.6 billion growth in the sector isn’t an accident; it’s driven by specific advantages that traditional travel cannot match:

- Guaranteed Availability: Unlike charters, which depend on market supply, fractional owners are guaranteed an aircraft even during peak holiday periods.

- Predictable Costs: You benefit from fixed hourly rates, protecting you from the price volatility seen in the charter market.

- Asset Liquidity: Most programs include a “buy-back” option, allowing you to exit the investment after a set period.

- Safety Standards: Fractional fleets often maintain higher safety certifications (ARG/US Platinum) and younger average fleet ages than older charter planes.

- Time Efficiency: Avoid TSA lines and arrive just 15 minutes before departure, saving an average of 3–5 hours per round trip.

Best Use Cases and Common Routes

Private aviation is no longer just for leisure; it is a strategic business asset. Common scenarios include:

- Multi-City Roadshows: Visit three cities in one day—a feat impossible with commercial airlines.

- Discrete Executive Travel: Secure, private cabins allow for confidential board meetings mid-flight.

- Urgent Cargo/Personnel: Moving specialized teams or equipment to remote job sites or manufacturing plants.

- Popular Routes: High-traffic corridors include Teterboro (TEB) to West Palm Beach (PBI) and Van Nuys (VNY) to Las Vegas (LAS).

Types of Private Aviation Options Available

1. Heavy Jets

Ideal for transcontinental and international flights. These aircraft, like the Gulfstream G650, offer “ultra-long-range” capabilities and full galleys.

2. Super-Midsize Jets

The “sweet spot” of the industry. They offer standing-room cabins and coast-to-coast range with better fuel efficiency than heavy jets.

3. Light and Very Light Jets (VLJs)

Perfect for short hops (1–3 hours) with 4–6 passengers. These are the most cost-effective options for regional business travel.

How to Choose the Best Option for Your Needs

Selecting the right provider in a $26.6 billion market requires due diligence. Consider these three factors:

- The 80/20 Rule: Choose a share or program that fits 80% of your missions. If you mostly fly solo but take one family trip a year, don’t buy a heavy jet share; buy a light jet share and “upgrade” for that single trip.

- Service Area: Ensure the provider has a strong presence in your primary regions to avoid “repositioning fees.”

- Safety Record: Always ask for the Wyvern or ARG/US safety rating of the fleet.

👉 Check Available Private Jets

Is Fractional Ownership Worth It?

The answer depends on your “Value of Time.” If your hourly rate or the value of your business deals is high, the hours saved by flying private pay for the investment. While the upfront costs are significant, the $26.6 billion industry valuation proves that for the world’s most successful people, the reliability, privacy, and speed of fractional ownership are worth every penny.

Frequently Asked Questions (FAQs)

1. Is fractional ownership cheaper than chartering?

If you fly more than 50 hours per year, fractional ownership or a dedicated jet card is often more cost-effective due to fixed rates and tax benefits. For occasional flyers, chartering remains the better choice.

2. Can I choose the specific pilots?

In most fractional programs, you do not choose specific pilots, but you are guaranteed pilots trained to the highest industry standards for that specific aircraft type.

3. What happens if my “share” jet is undergoing maintenance?

One of the biggest perks of fractional ownership is the “guaranteed backup.” If your specific plane is unavailable, the provider will provide an identical or upgraded model at no extra cost.

4. Are there tax advantages to fractional ownership?

Yes, in many jurisdictions, businesses can utilize MACRS (Modified Accelerated Cost Recovery System) depreciation, significantly lowering the “real” cost of the investment.

5. How long is a typical fractional contract?

Most contracts last between 3 to 5 years, after which the provider typically offers a buy-back of the share at fair market value.

Access the World of Private Aviation Today

The private aviation market is expanding at a record pace. Whether you are looking for fractional ownership, a jet card, or a bespoke charter for your next mission, the time to secure your position is now. Experience the ultimate in safety, privacy, and efficiency.

👉 Private Flight Options and Get Your Quote Now